Social care charities are particularly adept at spotting gaps in services for the most vulnerable in our communities, and as such are able to respond with early intervention programmes that can save both local authorities and health services a large amount of money. But, as a charity, how can you evidence that, or even start the conversation?

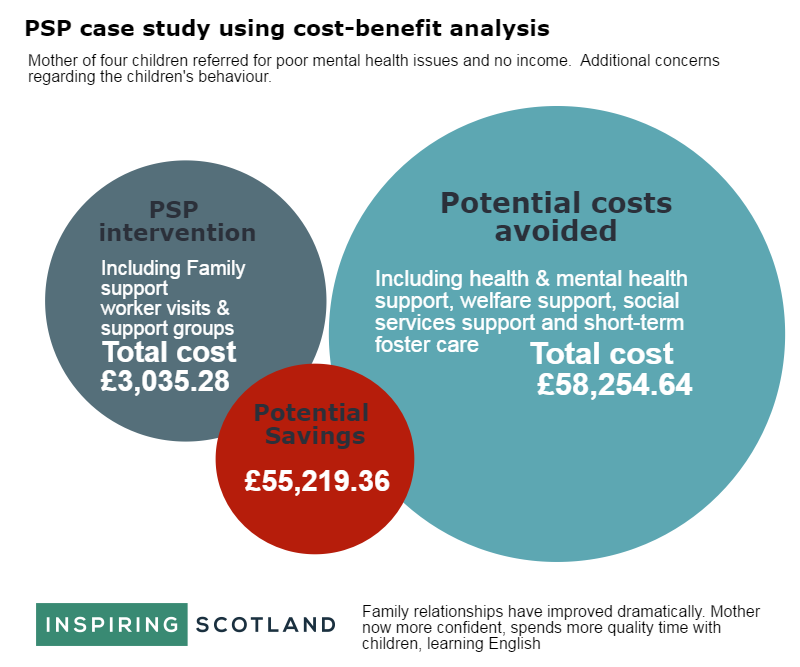

To do cost benefit analysis in the most robust and convincing way involves the collection and updating of quite a lot of data over time and can be resource intensive. In the limited time available to the Early Years PSPs projects, we put together a very basic approach based on the interventions over the short term of the PSPs and estimates of the potential costs avoided for representative samples of case studies. It is important to acknowledge that through the sample approach additional assumptions are built into findings and there is a risk of bias in the answers, which sceptical funders will be alert to.

However, by going through the process of undertaking a basic cost benefit analysis, you can begin to demonstrate the overall value and outcomes of your service in relation to its costs, as well as the potential savings to the public purse that can be made by you providing that service in the short term. By involving your public sector partners in the process, you can garner trust and start real partnerships and collaborations with the public sector to achieve your vision.

In our work with Early Years PSPs, we have put together a very basic process which may help you to illustrate public sector costs avoided.

This will enable you to:

So, is this just a magic formula?

No, but it is an additional “club in your bag” in funding discussions. We have put together a basic methodology informed by Karen Hancock’s work with us in 2015 as well as sources of information from the Early Intervention Foundation publication “Making an Early Intervention Business Case: Evidence and resources”. This paper provides excellent links to databases and cost calculators such as Personal Social Services Research Unit (PSSRU) “The Unit Costs of Health and Social Care”.

1. Collect the data

Remember, avoid optimism bias – be as real as you can be and keep them up-to-date – actual costs often turn out to be different from planned costs

2. Quantify the benefits of your service

3. Work out the formula for each case

CA- (PU x RUC = C) = Potential Savings

PU = Physical Units (e.g. Hours of particular sort of staff per week, hours of a facility, packs of play materials)

RUC = Relevant Unit Cost (e.g. wage rate per hour, room hire per hour, cost per pack of materials, cost per head of attending Christmas party) Ensure non-wage labour costs included (e.g. NI, pension). If you don’t know “on cost” for employees wage +25% normally is a good indication.

C = Costs of the project

CA = Costs Avoided consideration of what could have happened (checked by ‘critical friend’) and the potential costs.

However, words of caution. The assumptions will always be subjective and costs tend to be underestimated. The input of a “critical friend” to provide a reality check is vital. Always be clear about your assumptions and your reference data sources.

Bear in mind, this doesn’t take into account the time of when the savings occur. If savings occur in the longer term, to be more accurate a discount factor should be applied. A suggested factor is 3.5%.

Success Rates with cost benefits

Once you have worked out the potential costs avoided over the range of case studies, you can then estimate what the success rates need to be to cover those costs, which can be very powerful in times of scarce funding.

Average of potential cost savings over number of case studies x by total number of families helped in the project = total potential savings if service was 100% effective. Take the cost of your project as a percentage of the costs avoided to estimate the success rate required to potentially cover costs.

Bear in mind that a lot of assumptions are being made in arriving at these estimates, so it’s a good idea to carry out a sensitivity analysis on your key assumptions. What if costs were 50% higher than planned for example? Or if the benefits were only half as big as expected?

Summary

This process takes time, but it is certainly worth it. We have worked with a number of Early Years public social partnerships using this process over the last few months who have been able to identify potential savings to the “public purse” in most cases. On average the projects only needed to succeed in avoiding costs in around 25% of cases in order to cover the full costs of the service interventions. . Working collaboratively will always have its challenges, however, the ability to demonstrate the value you bring and what you can potentially save the public sector gives you a stronger voice at the commissioning table.

This week’s practitioner’s guide features bite-sized tips on encouraging play in the dark play from guest contributor Simon Cawthorne, Senior Play Ranger – Smart Play Network. These tips link in with our first ever podcast episode! Listen to our ‘Outdoor play is the way’ podcast: Ep 1 Playing in the dark -top tips for playing

Read MoreThe Place-based Programme Learning Exchange, a collaboration of national organisations that champion ‘place’ in their practices, has released a report highlighting what works and what doesn’t in place-based approaches. This report aims to share these key learnings to enhance both the scale and quality of place-based working across Scotland, and draws on over 50 years

Read MoreThis guide is designed to show you the range of possibilities when designing or developing high quality outdoor childcare provision. The list provides examples of practice combined with site-specific and appropriate design.

Read More